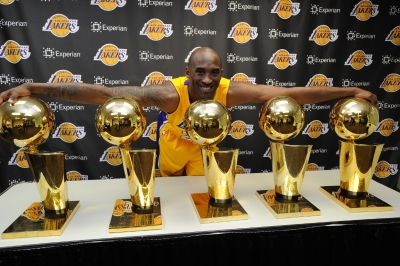

Kobe Bryant, one of the greatest basketball players of all time, recently announced he will be retiring at the end of the season. Since then, he has been much more candid than he has been in the past. In an interview with Ernie Johnson, Kobe had this to say on what advice he would give his younger self:

I would say “focus on human nature. You have to balance out understanding human nature with the obsession to understand the exact tactics of basketball.” And as I’ve gotten older I understood that you could execute until the cows come home but if you don’t understand human nature, if you don’t understand how to relate to others, if you don’t understand what makes them tick, you’re never going to win a championship.

Replace the word “basketball” with “investing” and I think you have some really wise advice on how to be successful financially. Essentially what Kobe is saying is that emotional intelligence, or EQ, is just as important as IQ. For advisors, as my coauthors and I have written before, understanding the technical side of investing doesn’t matter if one cannot communicate effectively. Empathy is a prerequisite for any relationship.

Furthermore, as we have written and demonstrated previously (see this and this), it is important to be eclectic in one’s learing. Kobe Bryant will go down as one of the greatest ever in his field, and it would be wise to heed his advice.